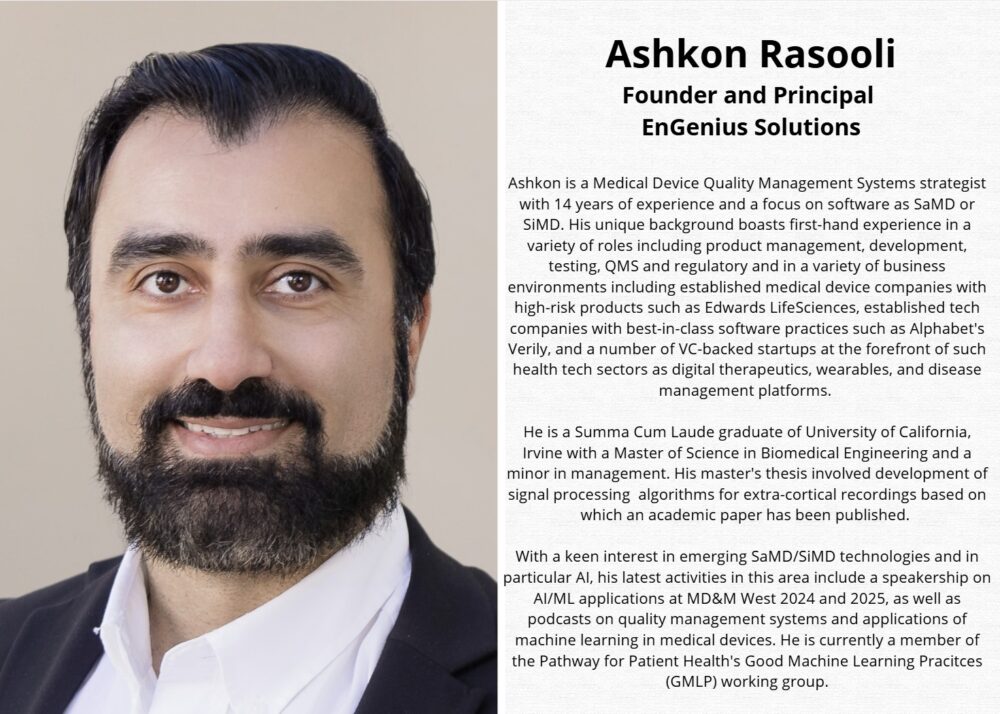

In this op-ed, Ashkon Rasooli, Founder and Principal at EnGenius Solutions, discusses the state of digital health in the United States in 2025.

Digital health encompasses a broad spectrum of technologies designed to transform healthcare delivery. The FDA defines digital health as including mobile health (mHealth), health information technology (IT), wearable devices, telehealth and telemedicine, and personalized medicine.[1] This revolution promises to address healthcare’s most pressing challenges: improving access to care, reducing costs, enabling early disease detection, and personalizing treatment approaches for better outcomes.

The global digital health market was valued at approximately $288-313 billion in 2024,[2][3] with North America commanding 37-43% of the global market share.[2][3] The growth trajectory is extraordinary: projections indicate the market will reach $946 billion by 2030, representing a compound annual growth rate (CAGR) of 22.2%.[2] This explosive growth is driven by multiple converging factors: smartphone penetration expected to reach 6.3 billion users by 2030,[2] the mounting burden of chronic diseases affecting millions of Americans, and potential government savings of up to 15% of health system costs through evidence-based digital investments.[4]

Disease Management: Wearables and Remote Patient Monitoring

Remote Patient Monitoring (RPM) utilizes technology to gather and transmit patient health data including blood pressure, glucose, and oxygen levels from remote locations to healthcare providers using connected devices.[5] The US RPM market reached $12.76-27.72 billion in 2024 and is projected to grow to $32-57 billion by 2030-2032,[6][7] with 46.3% of US hospitals now offering RPM services.[5]

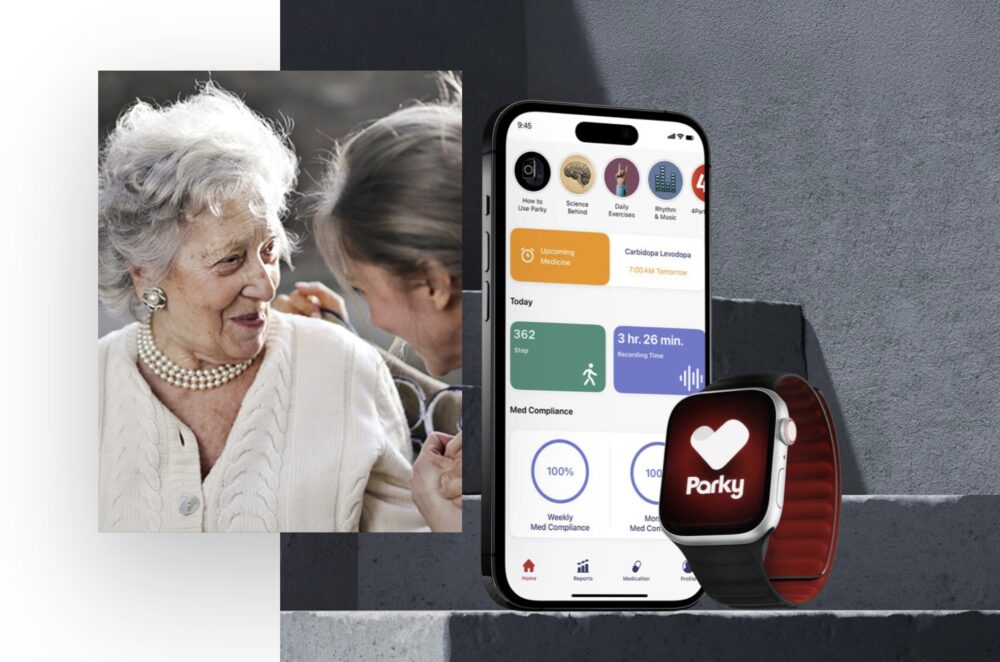

Leading companies include Medtronic, which in January 2025 launched the MyCareLink Smart Monitor, the world’s first app-based remote monitoring system for pacemaker patients;[8] Apple, whose Watch now features FDA-cleared ECG monitoring, atrial fibrillation detection, and health apps like Parky for monitoring Parkinson’s disease symptoms;[2][9] and Abbott, with its FDA-approved Freestyle Libre continuous glucose monitor and CardioMEMS implantable pulmonary artery sensor for heart failure monitoring.[10]

RPM delivers significant patient benefits: the University of Pittsburgh Medical Center reported that RPM devices reduced hospital readmissions by 76%,[11] while a 2025 study found that programs using cellular BP monitors for rural Medicaid mothers reduced hypertensive hospitalizations by 50%.[5] Continuous monitoring enables early intervention before patients experience symptoms.

Computer-Aided Diagnosis (CADx)

CADx leverages artificial intelligence, computer vision, and medical image processing to assist radiologists and pathologists in evaluating abnormalities in diagnostic images.[12] The US CADx market was valued at $742-892 million in 2021-2025 and is expected to reach $1,377-2,260 million by 2030-2032,[13][14] with modern systems achieving sensitivity up to 98%.[12]

Key players include EDDA Technology, whose FDA-cleared IQQA® Chest software provides real-time interactive diagnostic approaches for lung nodule analysis;[12] Hologic, a leader in breast CADx systems for mammography screening; and Fujifilm, which announced clinical trials in November 2021 for its REiLI Artificial Intelligence Platform for intracranial hemorrhage and breast cancer detection.[15]

CADx systems act as “second readers” to reduce false diagnosis rates,[12] while computer-aided digital mammograms expose patients to significantly less radiation than traditional film mammograms.[13] Early cancer detection through CADx significantly improves patient prognosis.

Prescription Digital Therapeutics (PDT/DTx)

Digital therapeutics are software-based therapeutic interventions delivering evidence-based treatments to prevent, manage, or treat medical disorders through clinically validated means.[16] The global DTx market was valued at $7.67 billion in 2024 and is projected to reach $32.5 billion by 2030, a CAGR of 27.77%,[17] though the industry faces challenges, with only 20 DTx approved by the FDA in 2024.[18]

Notable companies include Pear Therapeutics, developer of reSET®, the first FDA-cleared interactive DTx for cognitive-behavioral therapy of substance use disorder;[16] Akili Interactive, whose EndeavorRx® received FDA De Novo clearance as a video game treatment for pediatric ADHD and FDA approval for EndeavorOTC for adult ADHD in June 2024;[19] and Click Therapeutics, which received FDA clearance for Rejoyn® for major depressive disorder and launched Software-Enhanced Drug therapies in October 2024.[19]

DTx offers 24/7 accessibility without geographical constraints and personalization through AI-driven adaptive treatment plans. Clinical trials have demonstrated efficacy, including attention improvement in ADHD and reduction in substance use relapses.[16]

Companion Diagnostics (CDx)

Companion diagnostics are medical devices, often in vitro diagnostics, providing information essential for the safe and effective use of corresponding therapeutic products.[20] The global CDx market is projected to surge from $7.03 billion in 2024 to $22.83 billion by 2034,[21] driven primarily by oncology applications.

Leading companies include Foundation Medicine, whose FoundationOne CDx and FoundationOne Liquid CDx are FDA-approved platforms analyzing over 300 cancer-related genes to match patients with targeted therapies;[22] Roche, which received FDA approval in October 2022 for the first companion diagnostic identifying patients with HER2 low metastatic breast cancer;[23] and QIAGEN, which in August 2024 expanded its collaboration with AstraZeneca to develop companion diagnostics for chronic diseases using its QIAstat-Dx platform.[21]

CDx identifies patients likely to benefit from specific therapeutics, those at increased risk for serious side effects, or monitors treatment response to achieve improved safety and effectiveness.[20] CDx-guided drug development can reduce clinical trial costs by nearly 60%.[24]

General Trends and Challenges

The digital health industry faces several critical cross-cutting challenges. Reimbursement remains the primary barrier to commercial viability. While CMS introduced three new Digital Mental Health Treatment (DMHT) codes in the 2025 Medicare Physician Fee Schedule, marking a breakthrough for DTx,[25] RPM reimbursement through CPT codes like 99454 provides only $43.02 for 16+ days of data transmission monthly,[9] often insufficient to sustain programs. Clinical evidence generation presents unique challenges, as digital health interventions operate in largely uncharted regulatory territory without established precedents. Patient and provider engagement directly impacts effectiveness: provider adoption correlates strongly with reimbursement clarity, while patient engagement mirrors medication compliance issues, creating effectiveness curve variability that complicates outcome assessment.

Artificial Intelligence represents both opportunity and challenge. Over 1000 medical AI devices received FDA evaluation and approval as of 2025,[11] with the majority concentrated in CADx for radiology applications.[26] However, dataset limitations constrain AI development though initiatives like the FDA’s Medical Device Development Tools (MDDT) program and emerging Health Foundation Models aim to address this gap. Continuous post-market updates of AI/ML-enabled devices require ongoing regulatory oversight,[26] and the regulatory landscape remains uncertain with geographical disparities: the EU’s AI Act contrasts with the absence of comprehensive US AI regulations, though the FDA has issued Good Machine Learning Practices (GMLPs) and specific guidances for developers.

Navigating the Challenges to Unlock Full Potential

Digital health stands at an inflection point. With market valuations exceeding $300 billion and growth rates above 20% annually, the sector demonstrates undeniable momentum. Success stories from 76% reductions in hospital readmissions through RPM to breakthrough DTx approvals prove the technology’s potential. However, sustainable growth requires addressing persistent challenges: establishing comprehensive reimbursement frameworks, generating robust clinical evidence, maintaining patient engagement, and creating coherent AI regulatory pathways. The companies and healthcare systems that successfully navigate these challenges while delivering measurable patient outcomes will define the future of healthcare delivery in America.